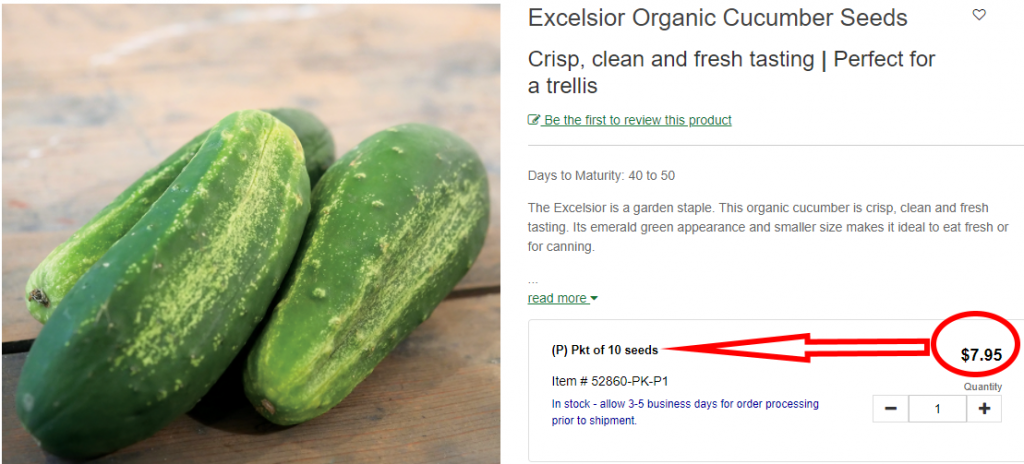

Just to warn you, even seeds are getting absolutely outrageous in cost:

A website dedicated to doing things smarter, not harder!

Just to warn you, even seeds are getting absolutely outrageous in cost:

Since the weather outside is frightful today and Mrs. SNH is out traveling the States, I thought it was about time to get onto a financial post.

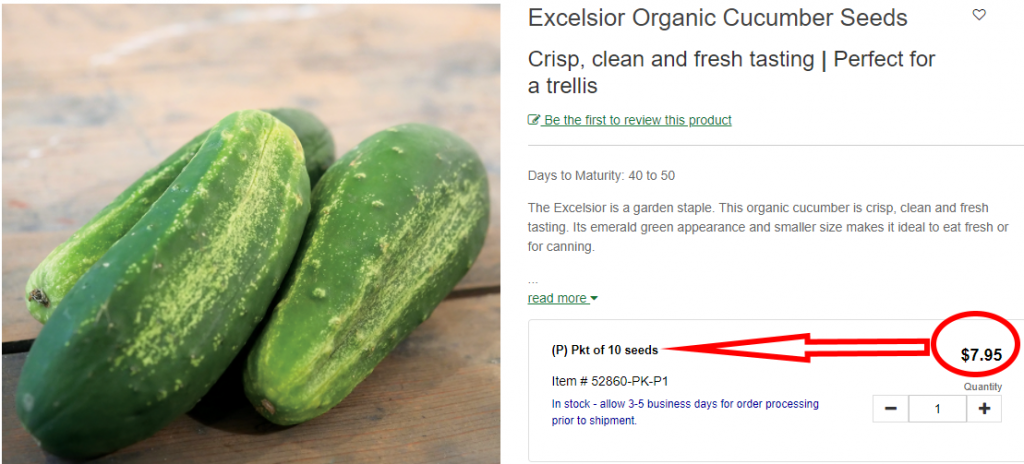

I am sure many of you are out there looking at your 401k and pondering how the US markets have lost about 12% since the beginning of the year and some funds losing much more if you happen to be in sectors like Tech. I am sure that the conflict in Ukraine and rapid inflation have something to do with it. How are you combating it?

I have put into place a policy of holding cash in my IRA until the markets start looking better. I am not pulling out of any investments that I have made since this has a fairly frequent history of happening and I am holding long positions. By holding “dry powder” in my portfolio, when a really solid opportunity comes around, I will have the cash to make a really good move.

For example, the real estate group “O” has lost 9% which is better performer than the S&P 500 index yet retains excellent value, returning dividends through the downturn just as it always has since 1994. I am using bellwether stocks such as O to gauge the right investment time to deploy cash when the market turns around and sentiment grows again.

These are key tools I am using to maximize my market moves to reduce losses in the down market.

For folks with a longer time horizon like myself:

For folks with a shorter time horizon (those in or near retirement):

I hope this helps ease some fears out there. Remember, rough times are ahead, but we can overcome them!

Work smarter, not harder!

Mr. SNH.

With the New Year upon us, it is a great time to review your financial plans. Some great areas to look at are:

My new year will start out by dedicating a deposit to a new high yield savings account and funneling part of that deposit into a taxable investment account. The reason I am adding a taxable account to our plan is to fill in the gap between short term savings and long term retirement goals. This middle-stage bucket of funds will allow some growth and allow us to use some of the dividends that we receive. A key difference between my taxable account and my “tax advantaged” accounts are as follows:

I may also look at sending back our TV box since our Roku provides the same functionality with our cable subscription. Doing so would save about $90 a year. At the end of the year, we may also decide to remove cable altogether and go back to antenna services since we seem to watch a relatively small number of channels and programs. We were cord cutters for a long time in Georgia and decided to trial cable again in Florida to see if there was a large benefit. I don’t currently think we get a good ROI for the service. Again, it is up to evaluation after a full year cycle with it.

Have a happy new year! Don’t forget to review your New Years financial plan. Keep building and growing.

Mr. SNH

I was doing some thinking about how managing your debt puts you ahead financially. We often talk about the smarter ways to invest money and different strategies therein. Managing your debt side payments can often be a bigger upside than your investments in terms of total benefit. This is because what you might be paying in interest is greater than your investment savings on the same value.

In this example, lets examine the case where you are given $5000 through a windfall. How do you use it effectively to give you the most benefit?

You have the following options in front of you.

1) Pay into your credit card that sits at 19.2% and you owe $5000 on it. Your minimum payment is $100 per month.

2) Pay into your medical debt of which you owe $9000.

3) Add to your taxable investment account of which is heavily invested in “tax exempt” funds with a nice MUNI CEF at 5%.

Analysis:

1) Over the lifetime of your credit card, to pay back the 5k you owe on it with minimum payments, you would be forking over a cool $20,313. So, for that 5k debt making the minimums, it ended up costing you $15,313.

2) A lot of folks end up with medical debt that has no interest accrued on the account. If it does have interest, it is often very low. So with this debt, we could say that you would ultimately pay between 9 and 15k. Max cost here for the debt side is around 6k, but it might also be nothing and varies by local laws. Some states have a maximum rate that can be charged for medical debt.

3) Assuming the 5% payout rate for the MUNI CEF, it would take you 29 years assuming a flat rate with a drip to get you to that 20k mark ($20,580.68).

For my money, I would go off with paying the credit card debt as it has the highest benefit and allows you to get cash positive quicker in the overall picture. I am personally on a track where I double my credit card payment to push it down as fast as I can. The high cost of taking loans and credit cards is a lesson we could all use and one that I am painfully too aware.

Mr. SNH.

I thought I would give a brief list of the things that have happened over the past few weeks.

I haven’t done a financial post in a while due to the depressing view of how Covid has changed the market landscape. I am back on the horse and thought I would examine how some of the metrics work that you may see in your stock analysis profiles in your investment and retirement accounts.

The Covid effect on your retirement portfolio was an alarm bell for me regarding risk. Most advisors qualify stocks and people into 3 risk groups: Sometimes, you see some designations in between these 3.

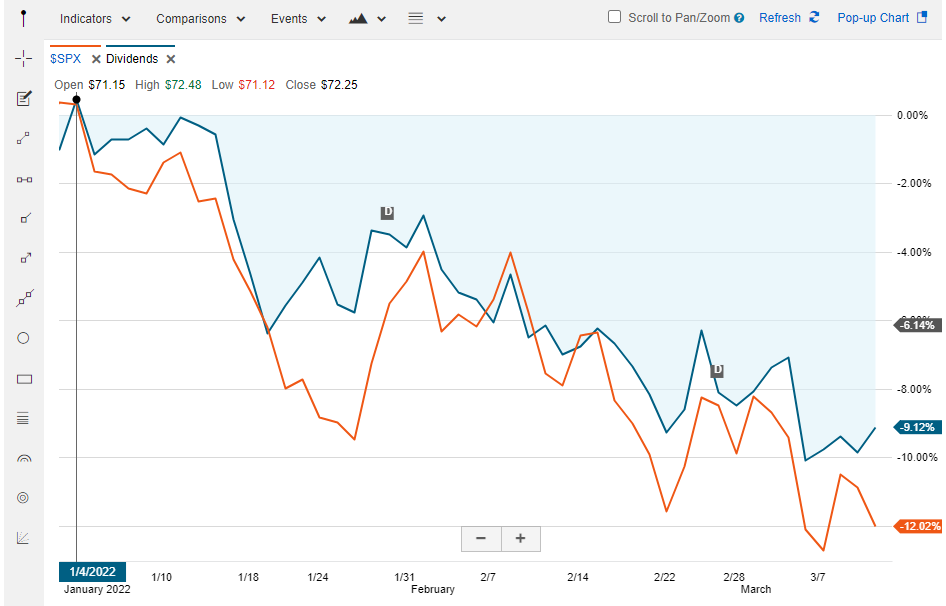

These risk profiles help an advisor define the portfolio that you should adhere to for your financial goals. I fall in between the High and Moderate profile since I have a good recovery time. If you’re in the same boat, don’t fret over the Covid dip. I believe this represents a buying opportunity for long term investors. Since I don’t have a fiduciary to assist with our goals, I wanted to examine how some of the metrics like Beta might be an indicator of risk. For reference, Beta is a measure of how much your stock choice varies against the stock market as a whole. So, if the idea is true, then those low risk stocks will have a low beta, but also return a lower percentage of gain over time. Conversely, when the market is in a big dip, it is also likely that they will swing further that the market as a whole.

I took data from my IRA provider and graphed return vs beta for large and mid caps with a beta between -1 and 2. 574 stocks were returned in the filter. It looks like there is a pretty decent correlation between the total return (5 years) and the beta value as stated above. Of course, we should consider that we have been in a Bull market for quite a bit of time and this data also represents the current drop due to Covid 19.

With concern to risk, those who move less in the market also tend to have less total return (under 300%). Those stocks who have a beta above 1 largely represented the largest gains in the last 5 years.

There is some caution though as you examine beta vs risk. There are multiple factors that should go into making decisions about how you invest. I was surprised at a few really strong performers on the list like Microsoft who had a Beta rating of .95 and Ascendis Pharma (.94), but had one of the best returns of all the companies. This tells me that Microsoft and Ascendis are still a great play for both those with lower risk and maybe* those who want to see the potential for a very high return. On the flip side, some like Darden Restaurants have only returned 28% over the last 5 years and maintain a higher Beta at 1.2, but would not likely be considered an investment in my book due to the low return in what was a strong bull market.

The conclusion here is that Beta is a good metric to judge how your stocks might perform relative to the market as intended, but it doesn’t dictate what the returns will be. It also warrants further investigation since there are clearly outliers that might indicate very weak companies with low returns in largely positive markets such as Darden. I think that Beta will be a go-to indicator for stock selection, but needs to be combined with many others to form a personal score factor.

–Notice–

I am not a professional investment advisor and use this blog to examine ideas on my own accord. Do not use these writings as professional investment advice. I do not currently hold a position in MSFT, DRI or ASND.

Greetings SNH’ers,

It has been a while since a post, mostly because a lot has been happening in real life! As the corona virus makes it’s mark upon the world, it is undoubtedly affecting you or someone you know. Since this blog focuses on finances, gardening and eventually the occasional fishing report it might be time to explore how I and the SNH family are dealing with it.

You may have noticed that food is in short supply at the grocery stores due to the panic caused by corona virus. It seems a run on toilet paper is in effct and you might not have gel alcohol based hand sanitizer. What are we to do!

Hopefully you had a great planting of winter vegetables and are seeing a harvest from your cold frames if you are in a cold climate. If you are in a subtropical as I am here in Florida, the oranges are in harvest and your spring garden should be in full swing! I am not yet harvesting anything out of it, but still maintain the goal that when we get to our permanent house we will produce about 1/3 of our own family food needs. In the meantime, find out if there are local farms that you might be able to get some fresh produce instead of your typical grocery channel. They can have great deals, don’t gouge and it supports your locals. We were able to score some great Oranges the other day from an ex-sunkist farm.

Just for fun, these are things we have growing: Bell peppers, Italian sweet peppers, blueberries, turnips, cantelope, a single zuchini, tomatoes, a few failing bush beans and cabbage. Oh, there are also a few bulb onions growing in a bin that we planted the other day as well as a handful of bunching onions that I threw into a grow bag with a blackberry bush. The truth is that the volume of these items is very small and we have poor soil, so if there was a genuine food storage issue, we would not be able to cover the need for the 6 people in our house. It is good practice for the next time. I’ll continue to learn how to read plants and ammend soil when it is “go time” for the bigger effort.

On the upside, the stock market crash has taken a huge tumble which represents a great buying opportunity! I can’t wait to get a big discount on some my steady dividend REITS and equity REITS. I am personally looking at putting into OHI, STOR or STAG as great stocks that kick out high dividends and have good upside potential. I also thought about O or FRT, but I still think O is overvalued even with the dip and FRT while attractively valued doesn’t match my growth need. Those two will make great income generators when I get close to retirement, but not now with my 30 year horizon to market exit. You might also be able to get into a good solar stock since solar is now a requirement in California for new buildings and you get to buy in at a low low rate!

While CV19 might be on your mind, remember to keep your wits about you, keep building, investing and growing. Think of fun ways to stay busy if you are on lockdown and help others when you can.

Wash your hands and say your prayers because Jesus and germs are everywhere.

Mr. SNH.

Greetings SNH’ers,

I am back with another good way to do things just a bit smarter. Passive solar heating ideas have been around for a long time. If you are new to the concept, then this might spur on a great idea for you!

Passive solar heating uses the sun to heat something without a 3rd party interruption. For example, a passive solar pool cover will help heat the water in your pool by focusing energy from the pool cover directly into the pool. A non-passive method might be using your electric pool heater with energy generated by the solar panels on your home.

Do you have a location around your home that is consistently a few degrees cooler that other portions of the home that you want to heat during the day? You can build a low cost passive heater for these kinds of spaces whether they be a garage, outbuilding or a spare bedroom. All you will need is a 2×4 frame, some clear plexiglass or clear corrugated plastic sheeting, black tubing commonly available at your local hardware store and a bit of time with your construction skills.

Step 1. Build a frame that can sit on the outside of your building that you want to heat.

Step 2. Cut a hole at the top and bottom of your building to support the in and outflow of air from your solar heater. The top will serve as a location for hot air exit, the bottom will serve the cool air entry into your heater. Some folks like to install a mechanical fixture to open and close the vents when they want to “turn on” passive heating in cool weather and “turn off” when weather is warm.

Step 3. Put your tubing into the frame. Weave the tubing from the bottom entry and wind it up to the top of the entry. This will allow the air to heat from the base. As the sun energy heats the air in the tubing it will rise through the tubing gaining additional heat through the frame. Once the tubing is affixed inside the frame, seal it with your plexiglass at the edges of the frame. If you are using the corrugated plastic method, ensure that the ends are sealed. “Great Stuff” sealant can be used for this purpose.

Step 4. Attach the cool side entry of your solar heater with another section of tubing to bottom entry of your building. Do the same for the top.

Step 5. Enjoy the great free heating you get during the daytime. The size of your frame and the volume of the space you intend to heat will determine your performance. I would recommend that an 8’x4’ passive heater frame be used for a 10×10 space for moderate gains. This is a very smart way to save some heating costs on your home during the cool spring and cool fall weather. It can also give your heating system a bit of help in the winter.

One great site with some good examples of a passive solar build can be found here: https://greenpassivesolar.com/2013/06/passive-solar-air-heater/. I like that they take the basic construction a bit farther and make the frame look like it belongs to the home.

This site, a bit more advanced, examines the incorporation of passive heating techniques in building design. This is a great read if you want to take the passive method up a notch. https://www.wbdg.org/resources/passive-solar-heating.

If you have any pictures of a passive solar heater that you have built, please share them!

I was realizing today how much more time we have during lunch breaks if we use what we have in the fridge for a quick meal. For example, this weekend I used a crockpot for some delicious adobe style chicken which fed the family a great dinner on Sunday. On the flip side, we were left with about a pound of chicken in leftovers. I simply wrapped those in a tortilla for a quick lunch yesterday and wrapped 2 up for a late-night dinner tonight. The amount of time saved by having such a quick meal was great! I got to spend more time with my 4 year old at lunch after she returned from preschool and I got to spend some extra family time with the kids this evening by opting for a delayed burrito wrap with the leftovers after the little SNHers were in bed.

The savings is two-fold too! Not only do we gain the time, but also save on our food costs. We are nearly at crisis level with how much food we (Americans) throw out in the trash each year. According to this article (https://www.marketwatch.com/story/this-is-why-americans-throw-out-165-billion-in-food-every-year-2016-07-22) we waste about 40% of our food! That is simply astonishing considering how much we pay for that food. In my household, our food budget is about 30% of our monthly spending.

The more we eat our leftovers, the more we do for our food system, our time and our wallets! Have a good night.

Greetings SNH’ers,

‘Going Green’ seems to be a topic on a lot of minds lately. I have always been fond of using the available energy we have to maximize the comfort in our homes and maximize the long term dollar in our pocket. This is the geothermal heating and cooling article!

There has been a lot of focus on Solar lately as groups like Enphase build smart charge controllers for your panels, solar panel costs are coming down, installation is getting easier and there are many tax-advantaged incentives for installing solar in your home.

I don’t often see much regarding tapping into the huge thermodynamic heat bath we have sitting right under our houses! Most geothermal heat pumps for homes have nearly double the lifespan of modern heating and cooling equipment according to many manufacturers, but it also takes significantly less power to operate a geothermal heat pump than it does to run other traditional heating like forced air with an electric heat pump or an electric baseboard system.

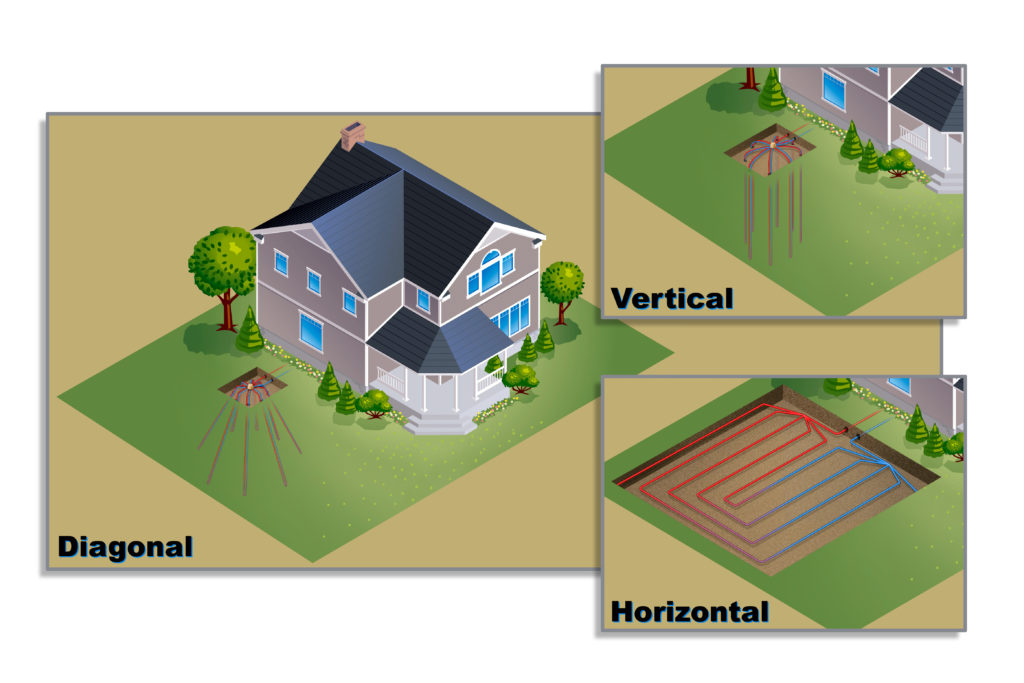

Geothermal installation may be suited better to new buildings as piping must run either vertically or extend horizontally from the base of your home into the heat battery of the earth. Older homes may require additional costs to retrofit as additional work in the slab may be necessary. The heating and cooling potential for your specific climate does change, but all areas across the United States see a benefit. According to Energyhomes.org, the payback period is between 2 and 10 years. A system that requires vertical duct-work deep beneath your home will have more labor associated than a system installed with a horizontal trench.

So if you are interested in learning more, I would check out energyhomes.org and talk to a local supplier of geothermal installations. Not only will you have a system that uses 40-60% less energy than a traditional HVAC solution, it also helps you sleep better night knowing you made a change that has a lower environmental impact in terms of fossil fuel generation from the electric company and it will give you money back in your wallet to put towards your retirement!

You can watch a great video here:

https://video.nationalgeographic.com/video/00000144-0a29-d3cb-a96c-7b2d99240000

Have a good night!