I haven’t done a financial post in a while due to the depressing view of how Covid has changed the market landscape. I am back on the horse and thought I would examine how some of the metrics work that you may see in your stock analysis profiles in your investment and retirement accounts.

The Covid effect on your retirement portfolio was an alarm bell for me regarding risk. Most advisors qualify stocks and people into 3 risk groups: Sometimes, you see some designations in between these 3.

- High Risk

- Moderate Risk

- Low Risk

These risk profiles help an advisor define the portfolio that you should adhere to for your financial goals. I fall in between the High and Moderate profile since I have a good recovery time. If you’re in the same boat, don’t fret over the Covid dip. I believe this represents a buying opportunity for long term investors. Since I don’t have a fiduciary to assist with our goals, I wanted to examine how some of the metrics like Beta might be an indicator of risk. For reference, Beta is a measure of how much your stock choice varies against the stock market as a whole. So, if the idea is true, then those low risk stocks will have a low beta, but also return a lower percentage of gain over time. Conversely, when the market is in a big dip, it is also likely that they will swing further that the market as a whole.

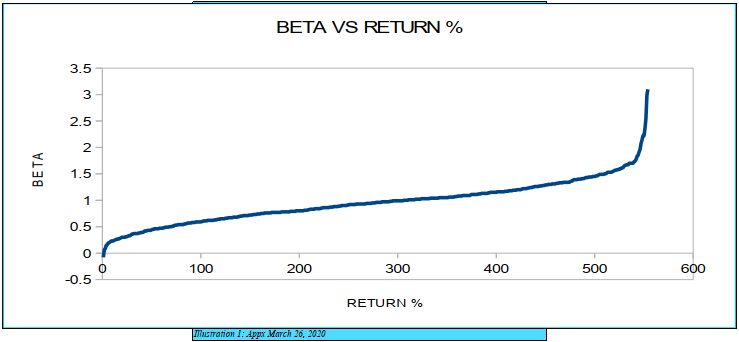

I took data from my IRA provider and graphed return vs beta for large and mid caps with a beta between -1 and 2. 574 stocks were returned in the filter. It looks like there is a pretty decent correlation between the total return (5 years) and the beta value as stated above. Of course, we should consider that we have been in a Bull market for quite a bit of time and this data also represents the current drop due to Covid 19.

With concern to risk, those who move less in the market also tend to have less total return (under 300%). Those stocks who have a beta above 1 largely represented the largest gains in the last 5 years.

There is some caution though as you examine beta vs risk. There are multiple factors that should go into making decisions about how you invest. I was surprised at a few really strong performers on the list like Microsoft who had a Beta rating of .95 and Ascendis Pharma (.94), but had one of the best returns of all the companies. This tells me that Microsoft and Ascendis are still a great play for both those with lower risk and maybe* those who want to see the potential for a very high return. On the flip side, some like Darden Restaurants have only returned 28% over the last 5 years and maintain a higher Beta at 1.2, but would not likely be considered an investment in my book due to the low return in what was a strong bull market.

The conclusion here is that Beta is a good metric to judge how your stocks might perform relative to the market as intended, but it doesn’t dictate what the returns will be. It also warrants further investigation since there are clearly outliers that might indicate very weak companies with low returns in largely positive markets such as Darden. I think that Beta will be a go-to indicator for stock selection, but needs to be combined with many others to form a personal score factor.

–Notice–

I am not a professional investment advisor and use this blog to examine ideas on my own accord. Do not use these writings as professional investment advice. I do not currently hold a position in MSFT, DRI or ASND.