Since the weather outside is frightful today and Mrs. SNH is out traveling the States, I thought it was about time to get onto a financial post.

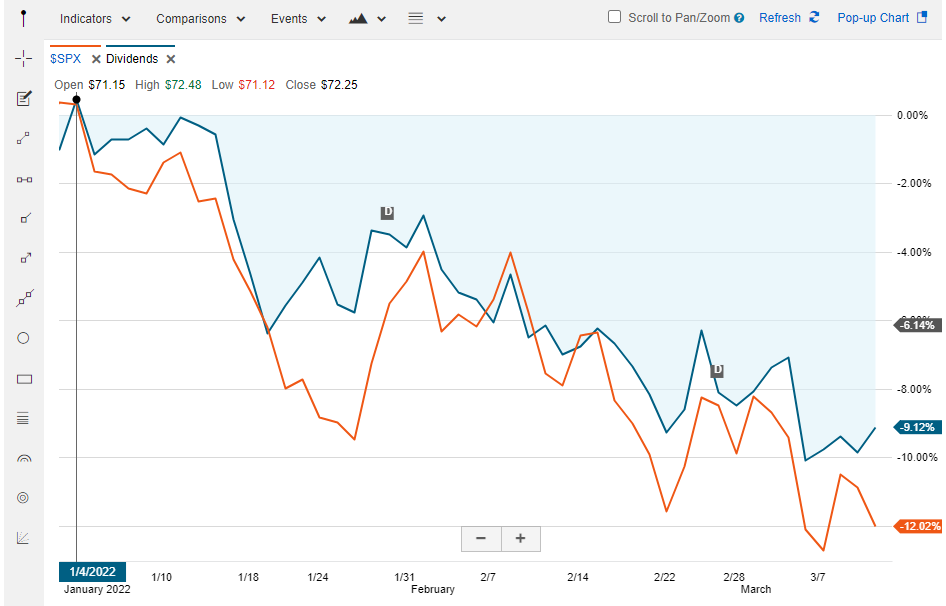

I am sure many of you are out there looking at your 401k and pondering how the US markets have lost about 12% since the beginning of the year and some funds losing much more if you happen to be in sectors like Tech. I am sure that the conflict in Ukraine and rapid inflation have something to do with it. How are you combating it?

I have put into place a policy of holding cash in my IRA until the markets start looking better. I am not pulling out of any investments that I have made since this has a fairly frequent history of happening and I am holding long positions. By holding “dry powder” in my portfolio, when a really solid opportunity comes around, I will have the cash to make a really good move.

For example, the real estate group “O” has lost 9% which is better performer than the S&P 500 index yet retains excellent value, returning dividends through the downturn just as it always has since 1994. I am using bellwether stocks such as O to gauge the right investment time to deploy cash when the market turns around and sentiment grows again.

These are key tools I am using to maximize my market moves to reduce losses in the down market.

For folks with a longer time horizon like myself:

- Keep a clear watch on overall markets

- Don’t pull investments just because you are frustrated. Those returning dividends in a drip cycle offer you the opportunity to lower your cost basis through the drip.

- If you do decide to place money into an investment, be hard nosed about which companies your are putting into. When we are in a bull market, everybody makes money. When we enter into corrections and depressions, analysis is king. Follow the advice from Ben Graham, Warren Buffet, and relative newcomers like Brian Preston who find true value in their investments and offer rock solid advice.

For folks with a shorter time horizon (those in or near retirement):

- Measure the impacts on your income

- Evaluate your market risk with a financial advisor

- Based your expected needs, form a plan to get through the hard times

- Look into alternative moves to reduce expenses or bring the income gap and keep your capital working.

- Rent out a spare room

- Move in with in-laws (if that is appropriate)

- Reduce services such as Cable TV. Antennas are fantastic for basic tv, and a low cost subscription on a roku work really nicely for media consumption.

- Garden – yeah, that one reduces your inflationary effect from rising food prices as well as gives you some great fresh air and exercise.

- Make your travel plans more local so your planned trips don’t cost as much.

- Plan your trips out during the day to maximize your gas cost

- Eat a bit more at home

I hope this helps ease some fears out there. Remember, rough times are ahead, but we can overcome them!

Work smarter, not harder!

Mr. SNH.